Capital Part 4: Organizational / System Impact

In an era of limited capital, and slowly recovering margins, organizations must exercise more caution and scrutiny than ever in deciding what will be funded. The changing landscapes of competition and consumer expectations can further complicate these decisions. In this series, we describe four types of criteria, and then some additional considerations, all designed to to help you choose the projects most likely to succeed. In the previous two posts, we introduced the first two of four important criteria: Strategic Alignment and Financial Feasibility.

In an era of limited capital, and slowly recovering margins, organizations must exercise more caution and scrutiny than ever in deciding what will be funded. The changing landscapes of competition and consumer expectations can further complicate these decisions. In this series, we describe four types of criteria, and then some additional considerations, all designed to to help you choose the projects most likely to succeed. In the previous two posts, we introduced the first two of four important criteria: Strategic Alignment and Financial Feasibility.

Like Strategic Alignment, the third criterion, Organizational / System Impact, is based on a broader, overall view of the organization. It could be seen as a derivative or hybrid of strategic and financial views. However, it can add some additional helpful perspectives in evaluating a capital investment.

Like Strategic Alignment, the third criterion, Organizational / System Impact, is based on a broader, overall view of the organization. It could be seen as a derivative or hybrid of strategic and financial views. However, it can add some additional helpful perspectives in evaluating a capital investment.

Growth and Sustainability: Each of these first two attributes have their own separate value and importance. However, when they are considered together, they have the added value of taking a more complete, longer view. Which potential projects have growth - in volume, revenue, and/or market share - as likely short-term outcomes, thereby helping to restore depleted capital reserves? While this is important, the possibility of organizational failure looms beyond the short term as competition responds, resource costs increase, or ever-changing consumer expectations outpace product/service improvements. These threats to long term sustainability suggest prioritizing projects that also have well-substantiated longer term growth projections, thereby contributing to organizational sustainability.

Personal Alignment: A second kind of sustainability is important to a growing number of customers who look beyond the goods or services received for a way in which they can personally connect with the providing organization. Some of these consumers are “shopping” for organizations that promote environmental sustainability, as evidenced through measures such as Carbon Footprint, LEED Certification, or Biodiversity Impact. For others, environmental sustainability is only part of a broader commitment expressed in the form of an Environmental, Social, and Governance (ESG) Score. Still others look for organizations with clear tangible evidence of Fair Trade or Diversity, Equity, and Inclusion practices. In health care, successful achievement of objectives outlined in a Community Health Improvement Plan will be valued by those looking to have a substantive impact on the health of their local community. Capital projects including one or more points of personal alignment will resonate and engender loyalty.

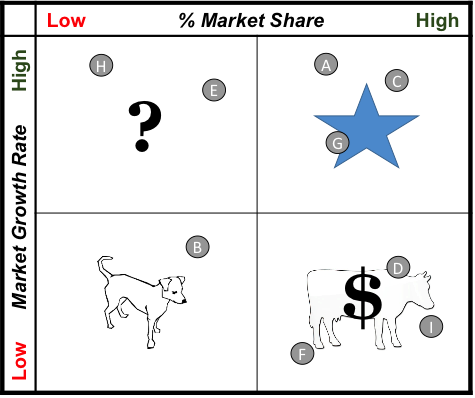

Portfolio View: Will the investment maintain favorable share in a growing market (Star Quadrant) or possibly fuel growth by improving share in a growing market (Question Quadrant)? How do you maintain items still providing high return but pay attention to product or service life cycles? The answers can be found by understanding where the capital investment fits in the traditional portfolio view (see Diagram). However, also take stock of how all other current services would be positioned in the portfolio. Remember the best portfolio for achieving long term sustainability is one with investments balanced among the four quadrants. Your organization may be better served by a capital project fitting into an under-represented quadrant.

Portfolio View: Will the investment maintain favorable share in a growing market (Star Quadrant) or possibly fuel growth by improving share in a growing market (Question Quadrant)? How do you maintain items still providing high return but pay attention to product or service life cycles? The answers can be found by understanding where the capital investment fits in the traditional portfolio view (see Diagram). However, also take stock of how all other current services would be positioned in the portfolio. Remember the best portfolio for achieving long term sustainability is one with investments balanced among the four quadrants. Your organization may be better served by a capital project fitting into an under-represented quadrant.

Patient Flow: Enhancing the patient’s experience is one of four critical components of the Quadruple Aim. Careful consideration should be given to the potential each capital project has to directly improve the customer experience. In addition, look for projects likely to improve the patient’s flow across the continuum of care. Will the project benefit the transitions to and from other services? Will it eliminate the need for additional service encounters or abbreviate the overall care experience by requiring fewer patient visits? Does it positively impact any other part of the patient’s journey? For example, Care/Case Management efforts are having significant beneficial impact on patient care and overall outcomes. This beneficial impact can be augmented through capital investments that, in and of themselves, make it easier for patients to transition from one care setting to the next.

Are you and your leadership team prepared to get the most out of your capital investments? Let us know if you have any additional thoughts as this series unfolds, or if we can be of any help applying these ideas in your capital project review, selection, and implementation processes.

Roberta Jelinek and Jeff Schilling

(This is the 4th of 7 posts in the series. For the full article, contact either one of us.)

Many organizations are working through an era of tight capital, reducing the margin for error on investment decisions to just about zero. And the current market volatility is only adding to the stress level surrounding these decisions. In this series, we describe how leadership teams can select the “best” projects to fund with limited capital from a large number of potential “game changers. The previous post introduced the first of four recommended criteria for selecting the best projects to fund. Some elements of that first criterion,

Many organizations are working through an era of tight capital, reducing the margin for error on investment decisions to just about zero. And the current market volatility is only adding to the stress level surrounding these decisions. In this series, we describe how leadership teams can select the “best” projects to fund with limited capital from a large number of potential “game changers. The previous post introduced the first of four recommended criteria for selecting the best projects to fund. Some elements of that first criterion,