Capital Part 7: Final Concepts

We began this series with a detailed explanation of four key criteria for selecting capital projects. In our previous installment, we focused on five critical factors for optimal implementation. Together, these principles form a strong foundation for successful capital investments. However, in today’s fast-evolving operating environment, a few additional considerations can make all the difference—insights our clients consistently emphasize as essential.

We began this series with a detailed explanation of four key criteria for selecting capital projects. In our previous installment, we focused on five critical factors for optimal implementation. Together, these principles form a strong foundation for successful capital investments. However, in today’s fast-evolving operating environment, a few additional considerations can make all the difference—insights our clients consistently emphasize as essential.

Speed to Market While careful execution is crucial, speed is equally important—not just for maintaining a competitive edge but for addressing urgent population need(s) as soon as possible. Internal politics and roadblocks can slow implementation and allow competitors to catch up or delay the critical population health benefits. Assigning a dedicated project manager can help mitigate these challenges. They can navigate such obstacles, identify time saving modifications and keep all stakeholders informed —minimizing confusion-driven delays and ensuring the project stays on track.

Partnering While partnership opportunities should ideally be explored early in the project planning phase, new collaboration possibilities often emerge as awareness of the project grows within the community.  These opportunities may arise with a competitor, in a different economic sector (e.g. retail setting), or with another organization in the human services sector focusing on one or more relevant social determinants. To assess these potential partnerships effectively, revisit the four Project Selection Criteria discussed earlier (see sidebar). Evaluate each opportunity for strategic alignment, financial impact, organizational/system influence, and risk. A well-chosen partnership can enhance project success, expand resources, and create long-term value.

These opportunities may arise with a competitor, in a different economic sector (e.g. retail setting), or with another organization in the human services sector focusing on one or more relevant social determinants. To assess these potential partnerships effectively, revisit the four Project Selection Criteria discussed earlier (see sidebar). Evaluate each opportunity for strategic alignment, financial impact, organizational/system influence, and risk. A well-chosen partnership can enhance project success, expand resources, and create long-term value.

Stakeholder Buy-In Like partnerships, stakeholder identification should ideally occur during the project’s conception and planning phases. Initial buy-in typically involves leadership, key staff, and referral sources who support the project’s vision and goals. However, as implementation unfolds, new challenges and opportunities may highlight the need for additional stakeholders with specialized expertise, resources, or influence. The implementation phase also presents an opportunity to reinforce and sustain stakeholder engagement…and avoid losing it. Regular updates, clear communication, and ongoing reinforcement of mutual benefits can help maintain alignment. Proactive ongoing communication minimizes the risk of roadblocks stemming from a surprised stakeholder, and the dilemma of whether to change the project in a way that accommodates them but doesn't fit with the original intent and purpose of the project.

Outsourcing Consideration should also be given to selective outsourcing, leveraging the same understanding of the operating system at the main component levels that would have been used with some of the implementation planning tools. For services, these are often considered to be people, environment, equipment, and policies & procedures. Can elements of any of these be outsourced in a manner that provides better value to the end customer?

The “Last Word”: Flexibility Even with a well-defined Capital Project Selection process built on the four key criteria and five implementation best practices discussed in this series, one personal trait remains critical: Flexibility. Market conditions, industry advancements, or even the nature of the project itself may shift after approval. A competitor may launch a similar initiative, or new technologies could impact project requirements—much like how the rapid adoption of virtual meetings during the COVID-19 pandemic reshaped space planning needs. Remaining flexible throughout Implementation Planning and Management is essential as changes of varying scale emerge. Allow teams to assess, adapt, and integrate necessary changes without losing sight of overall strategic goals.

Summary: Throughout this series, we’ve explored key criteria and tools to help you make informed, strategic capital investment decisions in an era of constrained funding. Even as capital pools begin to recover, demand for capital investments, driven by innovation and evolving market needs, will outpace available resources. Now more than ever, applying rigorous selection criteria and effective implementation strategies is crucial for maximizing impact. By leveraging the four key selection criteria, the implementation best practices, and the final concepts we’ve discussed, you can make the most of every capital investment—ensuring both resource stewardship and meaningful community impact.

Contact us at your convenience if we can be of any help or if you would like all seven parts of this series in a single article format.

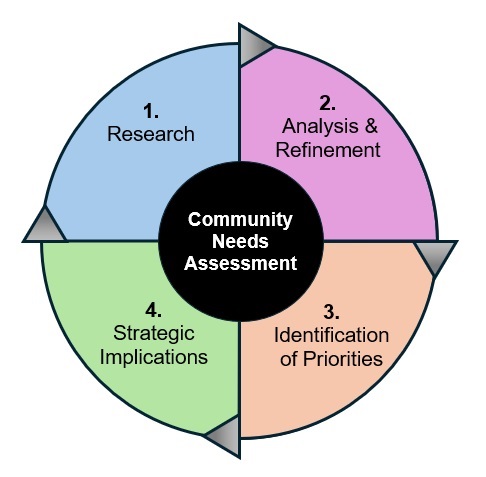

I really enjoy working on Community Needs Assessments (CNAs). For me, it’s the critical starting point on the road to meaningful measurable improvement in the health and wellbeing of all community members. So, you can imagine how excited I was when one of my clients invited me to join them in a Podcast to talk about the CNA that we just completed.

I really enjoy working on Community Needs Assessments (CNAs). For me, it’s the critical starting point on the road to meaningful measurable improvement in the health and wellbeing of all community members. So, you can imagine how excited I was when one of my clients invited me to join them in a Podcast to talk about the CNA that we just completed. Welcome to a new year, filled with new opportunities. And what better time to set the stage for success than at the beginning? You’ve probably heard this kind of thinking in one or more quotes (e.g. Well begun is half done – Aristotle). In fact, these first few weeks of the year really are ideal to engage in a couple of key activities that will create momentum and pay dividends through the months ahead. Let’s run through a short list of ways to leverage this perfect timing.

Welcome to a new year, filled with new opportunities. And what better time to set the stage for success than at the beginning? You’ve probably heard this kind of thinking in one or more quotes (e.g. Well begun is half done – Aristotle). In fact, these first few weeks of the year really are ideal to engage in a couple of key activities that will create momentum and pay dividends through the months ahead. Let’s run through a short list of ways to leverage this perfect timing.

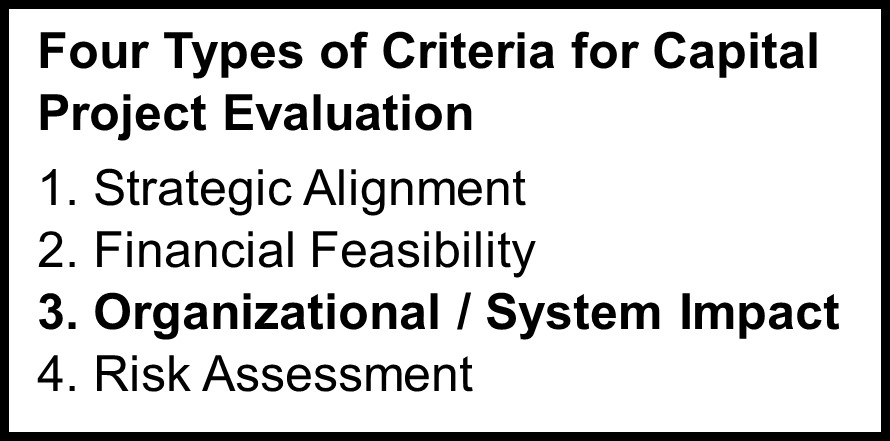

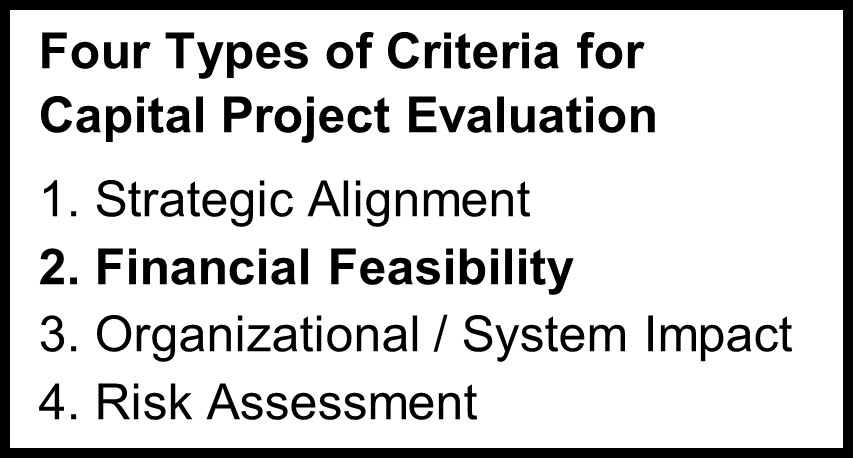

We suggest that there are four major types of criteria, each of which were addressed in previous posts in this series (see sidebar). If the selection criteria deserve extra scrutiny in an era of tight capital, then it stands to reason that implementation and project management also need added focus. And at that stage, it’s all about the details, especially these five.

We suggest that there are four major types of criteria, each of which were addressed in previous posts in this series (see sidebar). If the selection criteria deserve extra scrutiny in an era of tight capital, then it stands to reason that implementation and project management also need added focus. And at that stage, it’s all about the details, especially these five. As the calendar draws to a close it's a great time to look forward by looking back. What do I mean? You can use data from past performance to identify opportunities for future improvement. And none of this requires a lot of time, which probably sounds especially good during this holiday-infused, busy time of year. Let's take a closer look at several ways to “pay it forward” with your data.

As the calendar draws to a close it's a great time to look forward by looking back. What do I mean? You can use data from past performance to identify opportunities for future improvement. And none of this requires a lot of time, which probably sounds especially good during this holiday-infused, busy time of year. Let's take a closer look at several ways to “pay it forward” with your data. The concept of a Risk Assessment is not new, however incorporating a few tools and concepts can strengthen the reliability of the assessment. With these tools, the assessment can be more thorough and consider circumstances that might otherwise be overlooked. The fourth criterion, Risk Assessment, is intentionally positioned last so useful data gained from examining the other three can inform the risks to be considered.

The concept of a Risk Assessment is not new, however incorporating a few tools and concepts can strengthen the reliability of the assessment. With these tools, the assessment can be more thorough and consider circumstances that might otherwise be overlooked. The fourth criterion, Risk Assessment, is intentionally positioned last so useful data gained from examining the other three can inform the risks to be considered.

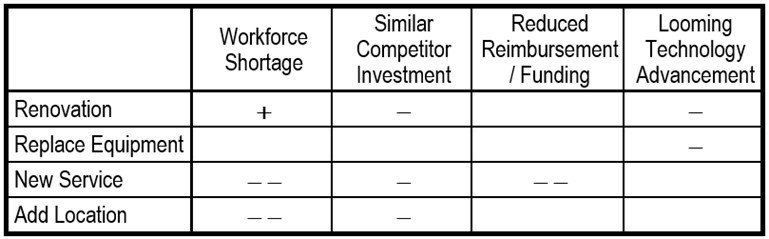

Some scenarios may relate to major trends (e.g. workforce shortage), while others stem from unique circumstances related to one or more of the requests (e.g. a competitor planning a similar investment). Use these as column headers in a matrix, with the various capital proposals as the row headers. Then, use symbols to indicate negative (-) or positive (+) impact that each scenario (column header) would likely have on each capital request (row header), keeping in mind that an empty cell (no impact) is also possible for any scenario/project combination. The completed table (see example at right) gives evaluators another way to compare the risk of the proposals.

Some scenarios may relate to major trends (e.g. workforce shortage), while others stem from unique circumstances related to one or more of the requests (e.g. a competitor planning a similar investment). Use these as column headers in a matrix, with the various capital proposals as the row headers. Then, use symbols to indicate negative (-) or positive (+) impact that each scenario (column header) would likely have on each capital request (row header), keeping in mind that an empty cell (no impact) is also possible for any scenario/project combination. The completed table (see example at right) gives evaluators another way to compare the risk of the proposals. In an era of limited capital, and slowly recovering margins, organizations must exercise more caution and scrutiny than ever in deciding what will be funded. The changing landscapes of competition and consumer expectations can further complicate these decisions. In this series, we describe four types of criteria, and then some additional considerations, all designed to to help you choose the projects most likely to succeed. In the previous two posts, we introduced the first two of four important criteria: Strategic Alignment and Financial Feasibility.

In an era of limited capital, and slowly recovering margins, organizations must exercise more caution and scrutiny than ever in deciding what will be funded. The changing landscapes of competition and consumer expectations can further complicate these decisions. In this series, we describe four types of criteria, and then some additional considerations, all designed to to help you choose the projects most likely to succeed. In the previous two posts, we introduced the first two of four important criteria: Strategic Alignment and Financial Feasibility. Like Strategic Alignment, the third criterion, Organizational / System Impact, is based on a broader, overall view of the organization. It could be seen as a derivative or hybrid of strategic and financial views. However, it can add some additional helpful perspectives in evaluating a capital investment.

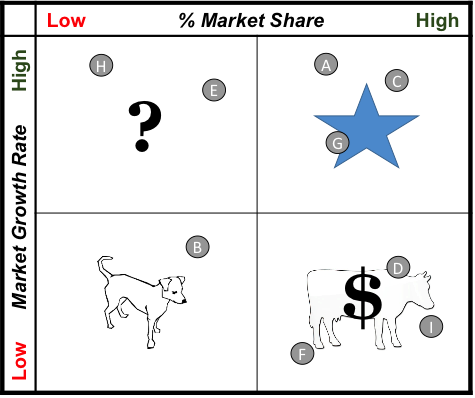

Like Strategic Alignment, the third criterion, Organizational / System Impact, is based on a broader, overall view of the organization. It could be seen as a derivative or hybrid of strategic and financial views. However, it can add some additional helpful perspectives in evaluating a capital investment. Portfolio View: Will the investment maintain favorable share in a growing market (Star Quadrant) or possibly fuel growth by improving share in a growing market (Question Quadrant)? How do you maintain items still providing high return but pay attention to product or service life cycles? The answers can be found by understanding where the capital investment fits in the traditional portfolio view (see Diagram). However, also take stock of how all other current services would be positioned in the portfolio. Remember the best portfolio for achieving long term sustainability is one with investments balanced among the four quadrants. Your organization may be better served by a capital project fitting into an under-represented quadrant.

Portfolio View: Will the investment maintain favorable share in a growing market (Star Quadrant) or possibly fuel growth by improving share in a growing market (Question Quadrant)? How do you maintain items still providing high return but pay attention to product or service life cycles? The answers can be found by understanding where the capital investment fits in the traditional portfolio view (see Diagram). However, also take stock of how all other current services would be positioned in the portfolio. Remember the best portfolio for achieving long term sustainability is one with investments balanced among the four quadrants. Your organization may be better served by a capital project fitting into an under-represented quadrant. Many organizations are working through an era of tight capital, reducing the margin for error on investment decisions to just about zero. And the current market volatility is only adding to the stress level surrounding these decisions. In this series, we describe how leadership teams can select the “best” projects to fund with limited capital from a large number of potential “game changers. The previous post introduced the first of four recommended criteria for selecting the best projects to fund. Some elements of that first criterion,

Many organizations are working through an era of tight capital, reducing the margin for error on investment decisions to just about zero. And the current market volatility is only adding to the stress level surrounding these decisions. In this series, we describe how leadership teams can select the “best” projects to fund with limited capital from a large number of potential “game changers. The previous post introduced the first of four recommended criteria for selecting the best projects to fund. Some elements of that first criterion,

When capital is limited and the possible investment opportunities are numerous, how can organizations select the “best” ones for funding?

When capital is limited and the possible investment opportunities are numerous, how can organizations select the “best” ones for funding? One includes important aspects of financial feasibility, while the other three add other considerations that reflect how the role of health care (and health care providers) is evolving. This broader definition of success mirrors the broader definition posed by concepts like the Balanced Scorecard and the Quadruple Aim.

One includes important aspects of financial feasibility, while the other three add other considerations that reflect how the role of health care (and health care providers) is evolving. This broader definition of success mirrors the broader definition posed by concepts like the Balanced Scorecard and the Quadruple Aim.