Capital Part 5: Risk Assessment

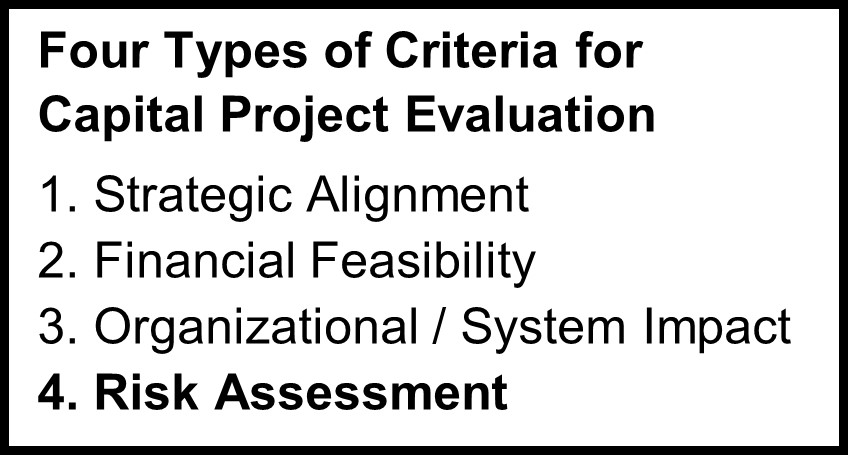

The concept of a Risk Assessment is not new, however incorporating a few tools and concepts can strengthen the reliability of the assessment. With these tools, the assessment can be more thorough and consider circumstances that might otherwise be overlooked. The fourth criterion, Risk Assessment, is intentionally positioned last so useful data gained from examining the other three can inform the risks to be considered.

The concept of a Risk Assessment is not new, however incorporating a few tools and concepts can strengthen the reliability of the assessment. With these tools, the assessment can be more thorough and consider circumstances that might otherwise be overlooked. The fourth criterion, Risk Assessment, is intentionally positioned last so useful data gained from examining the other three can inform the risks to be considered.

Critical Risks and Countermeasures (PDPC) Borrowed from process / quality improvement, the Process Decision Program Chart (PDPC) is designed to identify potential failures and the countermeasures to prevent them or minimize their impact. Building a PDCP begins with listing all the consequential potential failures associated with a proposed capital investment (e.g. critical supply shortage, inability to recruit key personnel, failure to meet key implementation milestone, etc.). Then, one or more carefully designed countermeasures are developed for each failure. For each capital request, have key failure points been identified and have the appropriate countermeasures been developed? If not, the risk of failure and associated consequences may be higher. A PDPC is an effective way to either design plausible counter measures or reverse-engineer a better plan and avoid the problems all together.

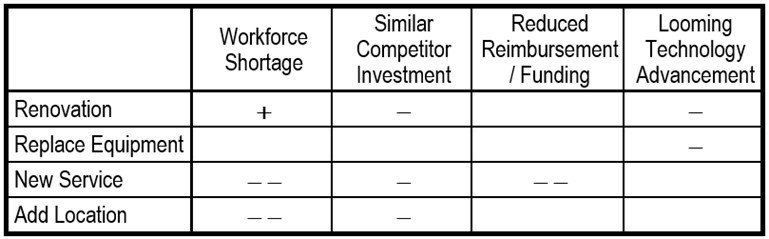

Scenario Sensitivity Analysis While a PDPC examines each project’s inherent risks, a Scenario Sensitivity analysis shifts the focus to the impact of the external environment. Begin by identifying a handful of Scenarios (typically 5 – 7) the key stakeholders are most concerned about.  Some scenarios may relate to major trends (e.g. workforce shortage), while others stem from unique circumstances related to one or more of the requests (e.g. a competitor planning a similar investment). Use these as column headers in a matrix, with the various capital proposals as the row headers. Then, use symbols to indicate negative (-) or positive (+) impact that each scenario (column header) would likely have on each capital request (row header), keeping in mind that an empty cell (no impact) is also possible for any scenario/project combination. The completed table (see example at right) gives evaluators another way to compare the risk of the proposals.

Some scenarios may relate to major trends (e.g. workforce shortage), while others stem from unique circumstances related to one or more of the requests (e.g. a competitor planning a similar investment). Use these as column headers in a matrix, with the various capital proposals as the row headers. Then, use symbols to indicate negative (-) or positive (+) impact that each scenario (column header) would likely have on each capital request (row header), keeping in mind that an empty cell (no impact) is also possible for any scenario/project combination. The completed table (see example at right) gives evaluators another way to compare the risk of the proposals.

Risk of not proceeding (opportunity cost) The last risk assessment tool is a concept you may have used in the past. Essentially, consider what may happen if the capital investment is not approved. In some cases, the consequences may be clear (maintenance costs, inefficiency, or code violations in outdated facilities), while in others, they may be more elusive (revenue or market share lost to a competitor). Are there risks of not proceeding related to evolving customer expectations or changes in reimbursement that are setting-dependent? The best project proposals have a thorough consideration of the risks of not proceeding that can be quantified and weighed against the projected benefits if the project is approved.

Four Criteria Meta Analysis In selecting the “vital few” capital investments from many proposals, each of the four criteria reviewed in this series has value as a point of discernment. Even more valuable is the ability to consider all four together, revealing not only the strongest proposals across all the criteria, but shedding light on any tendencies across projects. Preparing a quick “meta-analysis” of how the proposals compare across all four criteria can lead to some interesting questions…and improvements. For example, are most of the projects attractive from a Financial Feasibility perspective, while some are lacking in Strategic Alignment? Are there “stand-out” proposals in terms of Risk Assessment or Organizational / System Impact? These are important learning opportunities, and if leveraged, could result in even better options in the next capital approval cycle.

The “Other” List And yet, were’ not quite finished. Stay tuned for the last two installments in this series where we discuss several other considerations that may be applicable to individual proposals.

Are you and your leadership team prepared to get the most out of your capital investments? Let us know if you have any additional thoughts as this series unfolds, or if we can be of any help applying these ideas in your capital project review, selection, and implementation processes.

Roberta Jelinek and Jeff Schilling

(This is the 5th of 7 posts in the series. For the full article, contact either one of us.)

Leave a Reply

Want to join the discussion?Feel free to contribute!