Margins, and the capital investment pools they enable, are gradually recovering for some organizations. For most though, these funds are still scarce, so capital investments must be selected more carefully than ever. In this series we've been describing evaluation criteria that can be used to select the best investment opportunities. In this post, we focus on implementation and project management.

We suggest that there are four major types of criteria, each of which were addressed in previous posts in this series (see sidebar). If the selection criteria deserve extra scrutiny in an era of tight capital, then it stands to reason that implementation and project management also need added focus. And at that stage, it’s all about the details, especially these five.

We suggest that there are four major types of criteria, each of which were addressed in previous posts in this series (see sidebar). If the selection criteria deserve extra scrutiny in an era of tight capital, then it stands to reason that implementation and project management also need added focus. And at that stage, it’s all about the details, especially these five.

1. Certificate of Need Health care investments are regulated in many states by certificate of need laws. 35 states have these laws and three more have variants. In Michigan, for example, many types of facility acquisitions and capital expenditures require state approval for investments of $4,250,000 or more. Other nonprofits may have similar standards to consider. Knowing the laws, requirements, and/or standards to comply with is a detail you can’t afford to miss.

2. Process Flow Often capital investments are made to accommodate growth for services that claim to be “running out of space”. Process Flow Mapping can be a critical step to uncover the root cause of inefficient operations and can mitigate unnecessary capital investment. If additional space is a necessary part of the solution, it is important to map how the space will be used before designing it. Process Flow Mapping with front line staff can identify Critical Paths, where consideration of all required steps, hand-offs, and dependencies can expose vulnerabilities as well as points of emphasis in training before a project “goes live”. Even if the project is simply an additional location of an existing service, make sure all personnel are trained in all the relevant procedures, and those procedures have been adjusted as needed to accommodate any differences with the new space.

3. Key Dependencies Along those same lines, it is important to identify key dependencies related to physical assets, personnel and supplies. If helpful, think of these as supply chain vulnerabilities; recall how the Covid19 pandemic clarified how important those are. Does the project require a specialized team member, supply, or piece of equipment? What are the contingency plans if someone, or something, is suddenly unavailable. Have alternative sources been identified?

4. Contingency Planning Dependencies and vulnerabilities warrant contingency planning, and the Process Decision Program Chart (PDPC) is a great tool. We reviewed the PDPC previously in Part 5: Risk Assessment, the fourth and final major project selection criteria. Upstream in project selection, it provides evidence that the proponent(s) have already considered possible failure points and counter measures, further minimizing the risk associated with the project. And now, during Implementation Planning, any PDPC work already prepared should be reviewed and updated if needed. If one hasn’t been created yet, we definitely recommend doing so at this point.

5. Pilots and Trials Lastly, in many cases, a limited scale test run is very doable and can be extremely helpful in implementation planning. In preparing for a pilot or trial, take time to carefully define the scope and duration, as well as the success measure(s), procedures, training, and thorough debriefing. The lessons learned and critical success factors identified can lead to important process refinements. Attention to detail with pilots or trials will lead to smoother, trouble-free full-scale implementations.

Most of these implementation “details” are considered Project Management best practices. Other important steps include the composition of, and support given to the Implementation Team. Determine the key areas of expertise needed and if it will be needed throughout implementation (core team members) or at specific phases (ad hoc members). Will they need any resources, and how often should they meet? The answers to these and other questions will be a function of the nature and scope of each approved project, however the most successful teams have the necessary expertise and resources to guide the implementation from beginning to end. This includes basic project management skills, which can be leveraged either through relevant expertise among one or more team members or a facilitator skilled in project management. It is common for large, complex projects to have an assigned facilitator with project management certification.

Final Thoughts We have covered all four key Selection Criteria and now some key details of Best Practice Implementation. At this point the likelihood of success is near optimum. There are just a few remaining concepts for consideration which we will address next time in our last segment.

in a presentation to the West Michigan Association of Financial Professionals at their Fall Forum. What a great group! I had the pleasure of sitting in on some other presentations that day. All had valuable content, and some really insightful dialogue ensued. If you’re a financial professional in West Michigan, and already a member, you’re part of a great association. If you’re not a member, I encourage you to check them out!

in a presentation to the West Michigan Association of Financial Professionals at their Fall Forum. What a great group! I had the pleasure of sitting in on some other presentations that day. All had valuable content, and some really insightful dialogue ensued. If you’re a financial professional in West Michigan, and already a member, you’re part of a great association. If you’re not a member, I encourage you to check them out!

We began this series with a detailed explanation of four key criteria for selecting capital projects. In our previous installment, we focused on five critical factors for optimal implementation. Together, these principles form a strong foundation for successful capital investments. However, in today’s fast-evolving operating environment, a few additional considerations can make all the difference—insights our clients consistently emphasize as essential.

We began this series with a detailed explanation of four key criteria for selecting capital projects. In our previous installment, we focused on five critical factors for optimal implementation. Together, these principles form a strong foundation for successful capital investments. However, in today’s fast-evolving operating environment, a few additional considerations can make all the difference—insights our clients consistently emphasize as essential. These opportunities may arise with a competitor, in a different economic sector (e.g. retail setting), or with another organization in the human services sector focusing on one or more relevant social determinants. To assess these potential partnerships effectively, revisit the four Project Selection Criteria discussed earlier (see sidebar). Evaluate each opportunity for strategic alignment, financial impact, organizational/system influence, and risk. A well-chosen partnership can enhance project success, expand resources, and create long-term value.

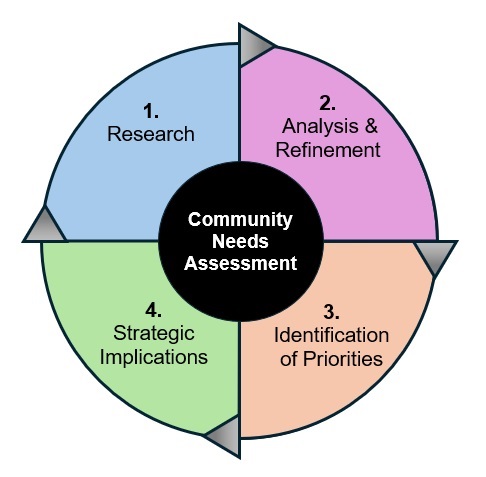

These opportunities may arise with a competitor, in a different economic sector (e.g. retail setting), or with another organization in the human services sector focusing on one or more relevant social determinants. To assess these potential partnerships effectively, revisit the four Project Selection Criteria discussed earlier (see sidebar). Evaluate each opportunity for strategic alignment, financial impact, organizational/system influence, and risk. A well-chosen partnership can enhance project success, expand resources, and create long-term value. I really enjoy working on Community Needs Assessments (CNAs). For me, it’s the critical starting point on the road to meaningful measurable improvement in the health and wellbeing of all community members. So, you can imagine how excited I was when one of my clients invited me to join them in a Podcast to talk about the CNA that we just completed.

I really enjoy working on Community Needs Assessments (CNAs). For me, it’s the critical starting point on the road to meaningful measurable improvement in the health and wellbeing of all community members. So, you can imagine how excited I was when one of my clients invited me to join them in a Podcast to talk about the CNA that we just completed. Welcome to a new year, filled with new opportunities. And what better time to set the stage for success than at the beginning? You’ve probably heard this kind of thinking in one or more quotes (e.g. Well begun is half done – Aristotle). In fact, these first few weeks of the year really are ideal to engage in a couple of key activities that will create momentum and pay dividends through the months ahead. Let’s run through a short list of ways to leverage this perfect timing.

Welcome to a new year, filled with new opportunities. And what better time to set the stage for success than at the beginning? You’ve probably heard this kind of thinking in one or more quotes (e.g. Well begun is half done – Aristotle). In fact, these first few weeks of the year really are ideal to engage in a couple of key activities that will create momentum and pay dividends through the months ahead. Let’s run through a short list of ways to leverage this perfect timing.

We suggest that there are four major types of criteria, each of which were addressed in previous posts in this series (see sidebar). If the selection criteria deserve extra scrutiny in an era of tight capital, then it stands to reason that implementation and project management also need added focus. And at that stage, it’s all about the details, especially these five.

We suggest that there are four major types of criteria, each of which were addressed in previous posts in this series (see sidebar). If the selection criteria deserve extra scrutiny in an era of tight capital, then it stands to reason that implementation and project management also need added focus. And at that stage, it’s all about the details, especially these five. As the calendar draws to a close it's a great time to look forward by looking back. What do I mean? You can use data from past performance to identify opportunities for future improvement. And none of this requires a lot of time, which probably sounds especially good during this holiday-infused, busy time of year. Let's take a closer look at several ways to “pay it forward” with your data.

As the calendar draws to a close it's a great time to look forward by looking back. What do I mean? You can use data from past performance to identify opportunities for future improvement. And none of this requires a lot of time, which probably sounds especially good during this holiday-infused, busy time of year. Let's take a closer look at several ways to “pay it forward” with your data. The concept of a Risk Assessment is not new, however incorporating a few tools and concepts can strengthen the reliability of the assessment. With these tools, the assessment can be more thorough and consider circumstances that might otherwise be overlooked. The fourth criterion, Risk Assessment, is intentionally positioned last so useful data gained from examining the other three can inform the risks to be considered.

The concept of a Risk Assessment is not new, however incorporating a few tools and concepts can strengthen the reliability of the assessment. With these tools, the assessment can be more thorough and consider circumstances that might otherwise be overlooked. The fourth criterion, Risk Assessment, is intentionally positioned last so useful data gained from examining the other three can inform the risks to be considered.

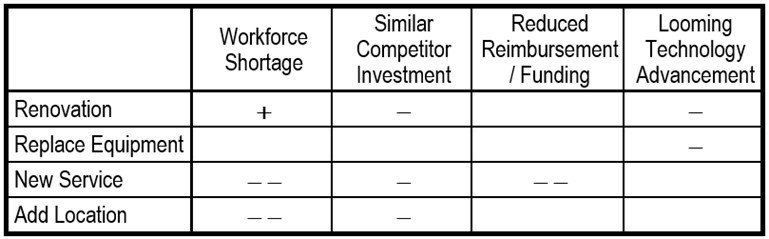

Some scenarios may relate to major trends (e.g. workforce shortage), while others stem from unique circumstances related to one or more of the requests (e.g. a competitor planning a similar investment). Use these as column headers in a matrix, with the various capital proposals as the row headers. Then, use symbols to indicate negative (-) or positive (+) impact that each scenario (column header) would likely have on each capital request (row header), keeping in mind that an empty cell (no impact) is also possible for any scenario/project combination. The completed table (see example at right) gives evaluators another way to compare the risk of the proposals.

Some scenarios may relate to major trends (e.g. workforce shortage), while others stem from unique circumstances related to one or more of the requests (e.g. a competitor planning a similar investment). Use these as column headers in a matrix, with the various capital proposals as the row headers. Then, use symbols to indicate negative (-) or positive (+) impact that each scenario (column header) would likely have on each capital request (row header), keeping in mind that an empty cell (no impact) is also possible for any scenario/project combination. The completed table (see example at right) gives evaluators another way to compare the risk of the proposals. In an era of limited capital, and slowly recovering margins, organizations must exercise more caution and scrutiny than ever in deciding what will be funded. The changing landscapes of competition and consumer expectations can further complicate these decisions. In this series, we describe four types of criteria, and then some additional considerations, all designed to to help you choose the projects most likely to succeed. In the previous two posts, we introduced the first two of four important criteria: Strategic Alignment and Financial Feasibility.

In an era of limited capital, and slowly recovering margins, organizations must exercise more caution and scrutiny than ever in deciding what will be funded. The changing landscapes of competition and consumer expectations can further complicate these decisions. In this series, we describe four types of criteria, and then some additional considerations, all designed to to help you choose the projects most likely to succeed. In the previous two posts, we introduced the first two of four important criteria: Strategic Alignment and Financial Feasibility. Like Strategic Alignment, the third criterion, Organizational / System Impact, is based on a broader, overall view of the organization. It could be seen as a derivative or hybrid of strategic and financial views. However, it can add some additional helpful perspectives in evaluating a capital investment.

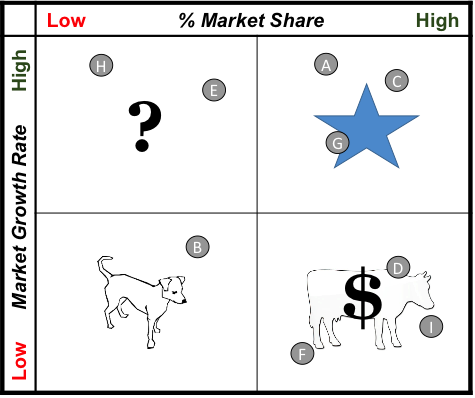

Like Strategic Alignment, the third criterion, Organizational / System Impact, is based on a broader, overall view of the organization. It could be seen as a derivative or hybrid of strategic and financial views. However, it can add some additional helpful perspectives in evaluating a capital investment. Portfolio View: Will the investment maintain favorable share in a growing market (Star Quadrant) or possibly fuel growth by improving share in a growing market (Question Quadrant)? How do you maintain items still providing high return but pay attention to product or service life cycles? The answers can be found by understanding where the capital investment fits in the traditional portfolio view (see Diagram). However, also take stock of how all other current services would be positioned in the portfolio. Remember the best portfolio for achieving long term sustainability is one with investments balanced among the four quadrants. Your organization may be better served by a capital project fitting into an under-represented quadrant.

Portfolio View: Will the investment maintain favorable share in a growing market (Star Quadrant) or possibly fuel growth by improving share in a growing market (Question Quadrant)? How do you maintain items still providing high return but pay attention to product or service life cycles? The answers can be found by understanding where the capital investment fits in the traditional portfolio view (see Diagram). However, also take stock of how all other current services would be positioned in the portfolio. Remember the best portfolio for achieving long term sustainability is one with investments balanced among the four quadrants. Your organization may be better served by a capital project fitting into an under-represented quadrant. Many organizations are working through an era of tight capital, reducing the margin for error on investment decisions to just about zero. And the current market volatility is only adding to the stress level surrounding these decisions. In this series, we describe how leadership teams can select the “best” projects to fund with limited capital from a large number of potential “game changers. The previous post introduced the first of four recommended criteria for selecting the best projects to fund. Some elements of that first criterion,

Many organizations are working through an era of tight capital, reducing the margin for error on investment decisions to just about zero. And the current market volatility is only adding to the stress level surrounding these decisions. In this series, we describe how leadership teams can select the “best” projects to fund with limited capital from a large number of potential “game changers. The previous post introduced the first of four recommended criteria for selecting the best projects to fund. Some elements of that first criterion,

When capital is limited and the possible investment opportunities are numerous, how can organizations select the “best” ones for funding?

When capital is limited and the possible investment opportunities are numerous, how can organizations select the “best” ones for funding? One includes important aspects of financial feasibility, while the other three add other considerations that reflect how the role of health care (and health care providers) is evolving. This broader definition of success mirrors the broader definition posed by concepts like the Balanced Scorecard and the Quadruple Aim.

One includes important aspects of financial feasibility, while the other three add other considerations that reflect how the role of health care (and health care providers) is evolving. This broader definition of success mirrors the broader definition posed by concepts like the Balanced Scorecard and the Quadruple Aim.